pa state and local tax deadline 2021

Quarterly filings and remittances are due within 30 days after the end of each calendar quarter. 2021 Personal Income Tax Forms.

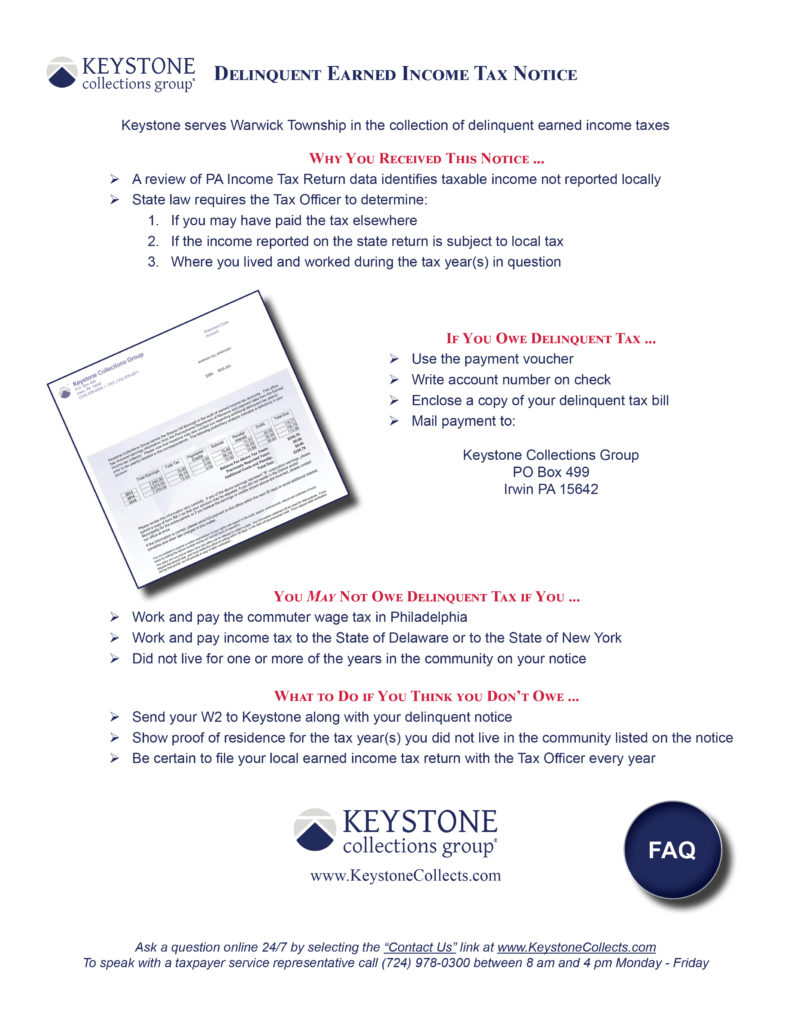

News Keystone Collections Group

So for Pennsylvania purposes.

. This means taxpayers will have an. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. The latest deadline e-filing Pennsylvania State Tax Returns is April 18 2022.

If applicable provide your local tax ID number to your payroll service provider. The federal and state government approved a delay for the filing and payment of 2020 income taxes but without action from the Pennsylvania General Assembly local tax returns are still due next week. Local taxes are still due on Thursday but fees.

Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. A safe convenient online filing option available from reputable vendors that allows qualifying individuals to file their state and federal returns. A secure state-only electronic filing system offered exclusively through the Department of Revenue which allows most taxpayers to prepare and submit their Pennsylvania personal income tax return for free.

Most often quarterly filings and remittances can be made directly through the local tax collectors website. June 15 Second 2021 Estimated Personal Income Tax Declaration and Payment for Individuals Estates and Trusts July 15 Second 2021 Installment Payment of Nonresident Withholding Tax PA-S Corporations and PartnershipsSept. We specialize in all Pennsylvania Act 32 and Act 50 tax administration services.

31 2021 can be e-Filed together with the IRS Income Tax Return by April 18 2022. As for your state taxes. TAX FORGIVENESS Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program.

The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021. May 17 is also going to be the due date to file your 2020 personal.

The personal income tax filing deadline was originally set for today April 15 2021 but the department in mid-March announced an extension to May 17. For the tax year 2021 the deadline to file 1099s with pennsylvania is january 31 2022 even if the date falls on a weekend or holiday. Pennsylvania is delaying the deadline to file state income taxesThe Pennsylvania Department of Revenue announced Thursday that the deadline for.

Dont panic if you havent filed your federal and state returns yet. The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021. The Bureau also collects Local Services Tax.

15 Third 2021 Estimated Personal Income Tax Declaration and Payment for Individuals Estates and Trusts. The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021. In this case 2022 estimated tax payments are not required.

Withhold and Remit Local Income Taxes. April 14 2021. The local earned income tax filing deadline is.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022. Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021. Pennsylvania has followed the federal lead Herzog explained.

The traditional April 15 tax-filing deadline is staring us in the face. We are the trusted partner for 32 TCDs and provide services to help Individuals Employers Payroll Companies Tax Preparers and Governments. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount.

Governor Tom Wolf today signed House Bill 766 into law aligning the annual state corporate tax deadline with the federal tax deadline of May 17 2021 and giving the Pennsylvania departments of Revenue and Community and Economic Development the ability to deal with state taxation while the COVID-19 disaster declaration is in effect. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that are made on or before May 17 2021 which is the extension for filing federal and state taxes. Contact us to quickly and efficiently resolve your tax needs.

Harrisburg PA The Department of Revenue is reminding the public that the deadline for filing 2020 Pennsylvania personal income tax returns and making final 2020 income tax payments is May 17 2021. 53 rows Federal income taxes for tax year 2021 are due April 18 2022. To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022.

All residents of Adams County and all residents of York County except West Shore School District file their annual earned income tax returns with YATB. We are Pennsylvanias most trusted tax administrator. Employers with worksites located in Pennsylvania are required to withhold and remit the local.

The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is monday april 18 2022 for most taxpayers. The 2021 Pennsylvania State Income Tax Return forms for Tax Year 2021 Jan. That is Keystone will not apply late-filing penalty and interest on tax year 2020.

Pa Taxpayers Encouraged To File State Returns With Free Online Option Pennsylvania News Wfmz Com

York Adams Tax Bureau Pennsylvania Municipal Taxes

Pennsylvania Pa State Tax H R Block

Pennsylvania Department Of Revenue

Where S My Pennsylvania State Tax Refund Taxact Blog

Pennsylvania Sales Tax Small Business Guide Truic

Tax Information Crafton Borough

Pennsylvania Tax Rate H R Block

Pa Tax Update 2021 R D Credit Award Letters Delayed Until May 1 2022

Pennsylvania Department Of Revenue Parevenue Twitter

Tax Preparation York County Libraries

Don T Pay Sales Tax For Home Improvements Ny Nj Pa

Not All Tax Deadlines Are Extended Which Tax Deadlines Affect You The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Taxes Warwick Township Bucks County

Bill Pay Drop Box Utility Bill Payment Paying Bills Tax Payment

.png)