stock option tax calculator ireland

If you sold all 500 shares then your total gain would be 2500. As a result you have to pay withholding tax at the time of exercise.

Discover Your Potential Recruitment Startup Company Funding Options Visit Http Wearessg Com Setting Up A Recruitment Business

Exercising stock options and taxes.

. The current Capital Gains Tax Rate is 33 so your tax bill would be 40590. Marginal tax rates currently up to 52 apply on the exercise of share options. Cost of Shares10000 shares 1 10000.

How to calculate and pay Relevant Tax on Share Options Rate of tax. The value of the benefit is the market value of the shares at the date they were awarded. EToro income will also be subject to Universal Social Charge USC.

Well cover four topics in this post. On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of. Assuming the 40 tax rate applies the tax on the share options is 8000.

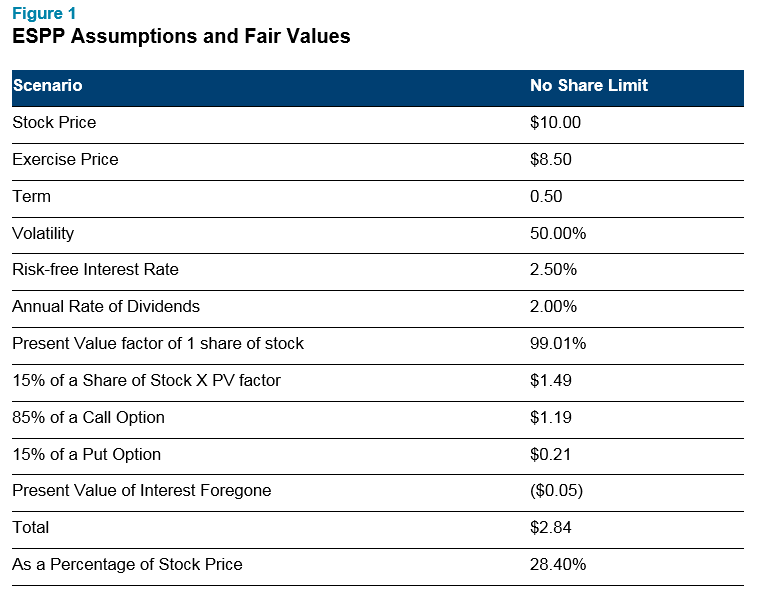

In October 2022 they are worth 800 each. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount.

If the shares are sold on or. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company.

Here is the information you need to know prior to jumping in. USC is tax payable on an individuals total income. Just follow the 5 easy steps below.

How to calculate the tax on share options. Let us introduce Emily who exercised her share options. Hi everyone Im interested in starting to trade US stock options contracts.

Ireland Income Tax Calculator 2022. ISO tax treatment and benefits. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below.

Restricted Stock Units RSUs Tax Calculator. So if you have 100 shares youll spend 2000 but receive a value of 3000. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system.

The relevant tax on share options is paid at 52. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. You paid 10 per share the exercise price which is reported in box 3 of Form 3921.

When you exercise a qualifying share option under the KEEP programme any gain will not be subject to income tax PRSI or USC. Exercising your non-qualified stock options triggers a tax. Income Tax rates are currently 20 and 40.

Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. Enter the commission fees for buying and selling stocks. 2 of the next 7862 2.

You purchase 10 Irish shares in January 2022 at a cost of 500 each. Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete returns of information Form RSS1 regarding the options. Enter the number of shares purchased.

The country profiles are regularly reviewed and updated as needed. Each share has gained 300 You sell 4 shares for 3200 creating a capital gain of 1200 which is below the 1270 exemption from CGT. ISOs are tax free at exercise but you may be subject to Alternative Minimum Tax AMT.

The Stock Calculator is very simple to use. See example below on how to calculate share profit. This incentive is available for qualifying share options granted between 1 January 2018 and 31 December 2023.

The Revenue website explains how the Capital Gains Tax works 33 for Irish and 40 for foreign properties if I understood correctly. From 2011 onwards PRSI 4 and the USC 8 charges also apply. The wage base is 142800 in 2021 and 147000 in 2022.

You must pay IT and USC at the higher rate. This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option. This form will report important dates and values needed to determine the correct amount of capital and ordinary income if applicable to be reported on your return.

Required ISO holding periods to receive. The gain will be subject to Capital Gains Tax when you dispose of the shares. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

Cynthia you and your staff have really developed a great package in the Advanced Neon Breakout. You must also pay Pay Related Social Insurance PRSI using the rate of the PRSI Class applied to you for. Example of Reduced Capital Gains Tax on Shares in Ireland.

Standard rates for USC for 2019 are 05 of the first 12012. The Global Tax Guide explains the taxation of equity awards in 43 countries. There are two types of options.

Your payroll taxes on gains from exercising your NQ stock options will be 145 for Medicare only if and when your earned income exceeds the wage base for the given tax year. Using the ESPP Tax and Return Calculator. Enter the purchase price per share the selling price per share.

Taxes for Non-Qualified Stock Options. So doing the longer Forex day trade M30 H1 or H4 really is a Incentive Stock. Non-qualified Stock Options NSO or NQSO and Incentive Stock Options ISO.

The Income Tax IT and Universal Social Charge USC due on the exercise of a share option is known as Relevant Tax on Share Options RTSO. Emily made an Exercised Share Profit of 20000. The income tax calculator for Ireland allows you to select the number of payroll payments you receive in a year this could be 12 1 a month 13 with bonus 14 with additional payments or more you can choose the number of payroll payments in the year to produce an annual income tax calculation.

4 HI hospital insurance or Medicare is 145 on all earned income. This gives the total tax bill of 10400. That means youve made 10 per share.

This is calculated as follows. Stock options There are a number of issues with the current taxation of stock options. Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment.

Two types of stock option taxes to keep in mind. The most significant implication for employees is a 25000 benefit. We do our best to keep the writing lively.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. These shares are a benefit in kind BIK. The due date for filing a return is 31 March following the end of the tax year.

And 8 of any remaining balance. Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans. Therefore employees have to use their salary andor other income or where possible sell sufficient shares in order to fund the taxes arising on exercise.

NSOs are reported as ordinary income when you exercise your options. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. Additionally you are only able to receive 100k.

45 of the next 50672. The problem is that there is literally no information in the Internet about how this activity would be taxed in Ireland. Any income tax due on the exercise of the option is chargeable under self.

I Incentive Stock Options Tax Calculator love it. Just so Incentive Stock Options Tax Calculator you know where I came from I was an e-mini trader for about four years and lost my shirt. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

The first 1270 of gains made by any individual in a tax year are exempt from Capital Gains Tax and so the taxable capital gain is 1230 ie.

.png?width=1952&height=840&name=Add%20a%20subheading%20(2).png)

Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland

Why Is Bitcoin Dropping Cryptocurrency Value Calculator Bitcoin Market Price Bitcoin Illegal Cryptocurrency Facebook Group Getting Started With Bitcoin Crypto

Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland

How To Calculate Net Operating Loss A Step By Step Guide

Pin By Jenn Rose On Realastute Home Buying Tips Home Buying Mortgage Tips

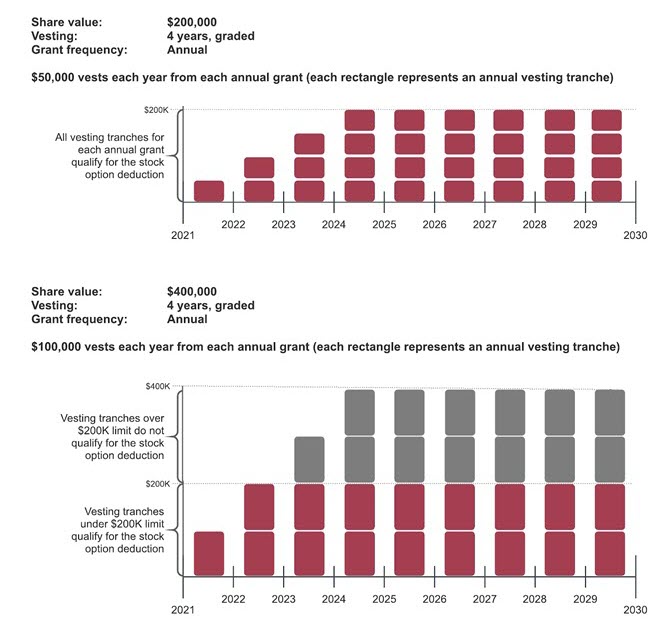

Tax Insights New Rules On The Taxation Of Employee Stock Options Will Be Effective July 1 2021 Pwc Canada

Isos Tax Return Tips And Traps Mystockoptions Com

Option Price Calculator American Or European Options

Isos Tax Return Tips And Traps Mystockoptions Com

13 Tax Deductible Expenses Business Owners Need To Know About Cpa Firm Accounting Taxes

Amt And Stock Options What You Need To Know Brighton Jones

How To Calculate Crypto Taxes Koinly

Crypto Profit Calculator Cryptocurrency Profit Estimator

Is Life Insurance Taxable Forbes Advisor

Shopping For Mortgage Rates Preapproved Mortgage Mortgage Rates Mortgage

Determining The Fair Value Of Your Espp

Mortgage Calculator With Pmi Taxes And Insurance Mortgage Payment Calculator M Mortgage Loan Calculator Mortgage Calculator Mortgage Amortization Calculator

Isos Tax Return Tips And Traps Mystockoptions Com

Debt Arrangement Scheme Scottish Das Mortgage Repayment Calculator Debt Problem Repayment